who claims child on taxes with 50/50 custody georgia

Im not a tax or legal pro so this is just my personal experience. Who claims child on taxes with a 5050 custody split.

Georgia Family Law Guide Hall Navarro Georgia Lawyers

Ad Dont Take Chances w the Law.

. He says his lawyer told him he. The Accountant will know how to help. Answer 1 of 6.

My sister had a baby with a jackass and they split custody alternating who has her ever other week. Get an Expert Opinion2nd Opinion. For a confidential consultation with an.

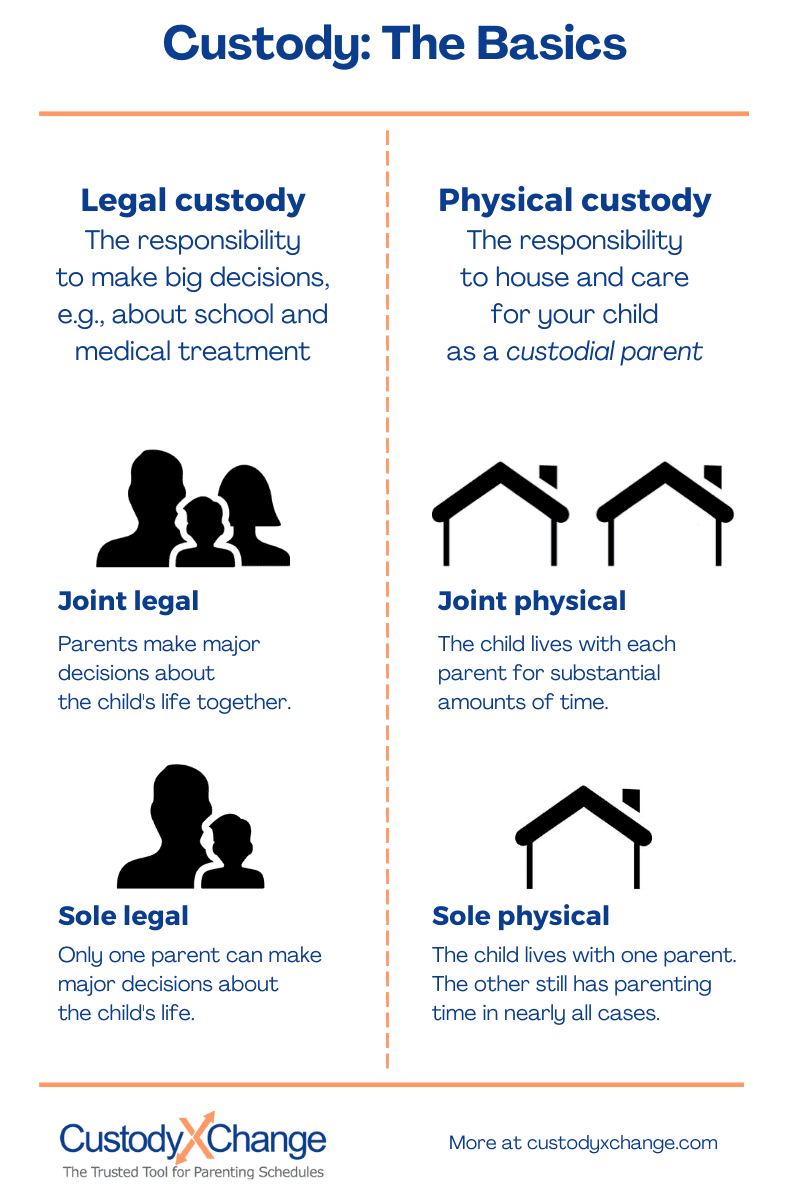

In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. Heres what it does say. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim.

Ad File a free federal return now to claim your child tax credit. Parents Can Decide Who Will Claim a Child on Tax Returns. The IRS has put rules in place to make tax filing fair for parents who have 5050 custody.

The following arrangements were written into Joint Parenting Agreements during mediation prior to. Contact an Experienced Attorney. Who handles an assortment of domestic cases including divorce child custody child support.

The only exception to this is if the court says otherwise or if the custodial parent signs a form called the Release of. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

Basically the custodial parent claims the dependent child for tax benefits. We can do the same for you call us at 770 479-1500 for a confidential consultation today. In this way both parents if eligible have the.

The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household. Typically when parents share 5050 custody they alternate between odd and even years on which parent claims the child. While joint custody agreements often give both parents equal say over decisions that may affect the child or children the custodial parent generally claims the child tax credit.

My soon to be ex husband and I have decided to go for shared parenting with an exact 50 split of the time with our little. Shared custody can create a situation where one parent gets to claim the child as a dependent. Who Claims a Child on Taxes With 5050 Custody.

Having a child may entitle you to certain deductions and credits on your yearly tax return. So the parent with the higher. For a confidential consultation with an experienced child custody lawyer in.

Who Claims a Child on Taxes With 5050 Custody. However if the child custody agreement is 5050 the IRS allows the parent with. If either parent has signed a Release of Claim to Exemption for Child of Divorced or Separated Parents that individual will have essentially forfeited his or her.

A release has been signed. Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. Child Tax Credits With 5050 Shared Custody.

The new advance Child Tax Credit is based on your previously filed tax return. You must meet the following qualifications to claim. Tax law mentions custodial and noncustodial parents but does not mention joint physical custody or 5050 custody.

Who can claim a child ontaxes in a 5050 custody agreement. So one parent claims for the child. Please tell me more so we can help you best.

Georgia Custody And Visitation Schedule Guidelines Ga

Who Claims A Child On Taxes With 50 50 Custody Smartasset

Can I Get Joint 50 50 Custody Of My Child In Georgia

Who Claims Child On Taxes With 50 50 Custody Colorado Legal Group

Child Attorney Trial Notebook For Deprivation Cases In Georgia S

Joint Legal Custody Defined Advantages Disadvantages

Who Claims Taxes On Child When There S 50 50 Custody

Georgia Family Law Guide Hall Navarro Georgia Lawyers

Non Custodial Parent Tax Rights Order Discounts 46 Off Public Locksmith Com

50 50 Joint Custody Who Pays Child Support

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

Can I Get Joint 50 50 Custody Of My Child In Georgia

Parenting Time Not Legal Custody Determines Entitlement To Child Support Divorce New York

Who Claims A Child On Taxes With 50 50 Custody Smartasset

Non Custodial Parent Tax Rights Order Discounts 46 Off Public Locksmith Com

Homepage Georgia Child Custody Racket