tax service fee definition

For example lets assume that John buys a house. A fee a company or bank assesses for providing an unusual service.

What is a Tax Service Fee.

. Specifically this article examines when fee-for-service activities may be inconsistent with the missions of organizations exempt under section 501c3 of the Internal Revenue Code the Code. In an effort to avoid these limitations lawmakers are playing political semantics between what a tax is and a fee is. The servicing company sets up an escrow account for the buyer and pays the buyers taxes and homeowners insurance from that account.

It includes material cost direct or service that is being purchased. A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time. He borrows 100000 from Bank XYZ to make the purchase.

It is also called a service fee. A fee by definition is a voluntary payment. There is a service fee involved in ordering taxi service.

Under a fee-for-service approach physicians hospitals and medical care providers in general are paidreimbursed based upon the nature and especially the volume of services they provide to a given patient. Tax Service Fee means the nonrefundable tax service fee in the amount set forth in the Program Guidelines initially 8500 payable by each Lender to the Servicer upon purchase of a Mortgage Loan. Introduced under Section 65 of the Finance Act 1994 service tax was on July 2017 replaced by Goods and Services Tax GST which subsumed the various types of indirect taxes.

2012 Farlex Inc. Section 194J of The Income Tax Act 1961 pertains to deduction of tax at source in case of fees for professional or technical services. Reporting requirements for gratuities The IRS has specific reporting requirements for employee tips that must be followed by employees and business owners alike.

For example a new law in Kentucky recently added veterinary care landscaping work and campsite rentals to the list of service providers that must charge a 6 percent sales tax. Any assessment that raises money in excess of what is needed to defray costs is a tax. Service tax was an indirect tax levied by the government on services offered by service providers.

Title insurance can provide protection if someone later sues and says they have a claim against the home. For example a bank may assess a service charge if a person who does not have an account withdraws money from that banks ATM. Taxes largely finance the activity of government in providing free or subsidised goods or services to society such as in the provision of public and merit goods.

How Does a Tax Service Fee Work. A fee a company or bank assesses for providing an unusual service. A service charge also called a service fee refers to a fee collected to pay for services that relate to a product Cost of Goods Sold COGS Cost of Goods Sold COGS measures the direct cost incurred in the production of any goods or services.

A taxpayer cannot demand any special favour from the authority in return for taxes paid by him. Additional Services has the meaning set forth in Section 23. In other words a service charge is an additional charge for the service.

This means that service charges are treated as regular wages for tax purposes. It applies to TDS on payment of any sum by way of a fees for Professional services b fees for Technical services c Remuneration or fees or commission paid to directors excluding salary d Royalty. Part Two will discuss the basic rules for determining whether a fee-for-service activity triggers unrelated business income tax UBIT.

A fee is a direct payment by those who receives some special advantages or the government guarantees the. Tax service fees exist because lenders want to. Simply put a tax service fee is paid to the company that services the loan.

For example a bank may assess a service charge if a person who does not have an account withdraws money from that banks ATM. An individual who receives the payment is called a retainer provider service provider expert or consultant. Service fee - a percentage of a bill added in payment for service service charge charge - the price charged for some article or service.

Services Fees means any services fee set out in the Proposal or in the absence of such fees in the Proposal the services fees notified by Nuix to the Licensee. Definition Fee-for-Service The current and predominant model for providing medical care in the United States. Youre the one who puts the money in.

Updated on January 05 2020 Fee for service in real estate is a financial model that charges the client for real estate listing or buyer services based on services performed rather than a negotiated percentage of the selling price. Retainership providers or service providers may be. This pricing model can take various forms.

A service fee is a monetary charge added to a customers bill or account for a service that has been provided by a business. The payer of the retainer fee is called the service receiver or the client. Service tax was paid to the government in exchange for different.

A retainer fee is nothing but a fixed price paid upfront to a person for receiving a specified service. Secondly as far as tax is concerned there is no direct give-and-take relationship between the taxpayer and the tax-levying authority. There are numerous types of such fees that vary by industry.

Common claims come from a previous owners failure to pay taxes or from contractors who say they were not paid for work done on the home before you purchased it. Six General Types. It is also called a service fee.

A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time. What is a tax and what is a fee. Title service fees are costs associated with issuing a title insurance policy for the lender.

A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time.

9 Horrible Tax Mistakes Homeowners Make All The Time Tax Mistakes Irs Taxes Business Tax Deductions

What Is The True Definition Of Wealthmanagement Johnsonmorganti Financialconcierge Whitegloveservice Wealth Management Concierge White Gloves

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

Audits Of Companies In 2022 Financial Statement Audit Chartered Accountant

New Act Has Drastically Expanded The Definition Of Foreign Companies And Have Benifited Via Electronic Mode Company Investing Facts

In This Article We Will Provide The Definition Of Value Analysis Value Engineering Methodology And Discuss The Techn Analysis Engineering Values Education

Tax Preparation Fees Everything You Should Know Ageras

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

Taxes And Fees Paying Financial Charge Obligatory Payment Calculating Personal Income Tax Doing Your Taxes Tax Credit Metaphors Ve Income Tax Tax Income

Pin On Latest Updates About The Tax Compliance

Everything You Need To Know About Self Employment Taxes Self Employment Business Tax Small Business Tax

How To Calculate Taxes And Discounts Basic Concept Formulas And Examples Cuemath

An Independent Contractor Is A Person Or Entity That Contracts With Another To Perform A Particular Task Business Tax Independent Contractor Education Poster

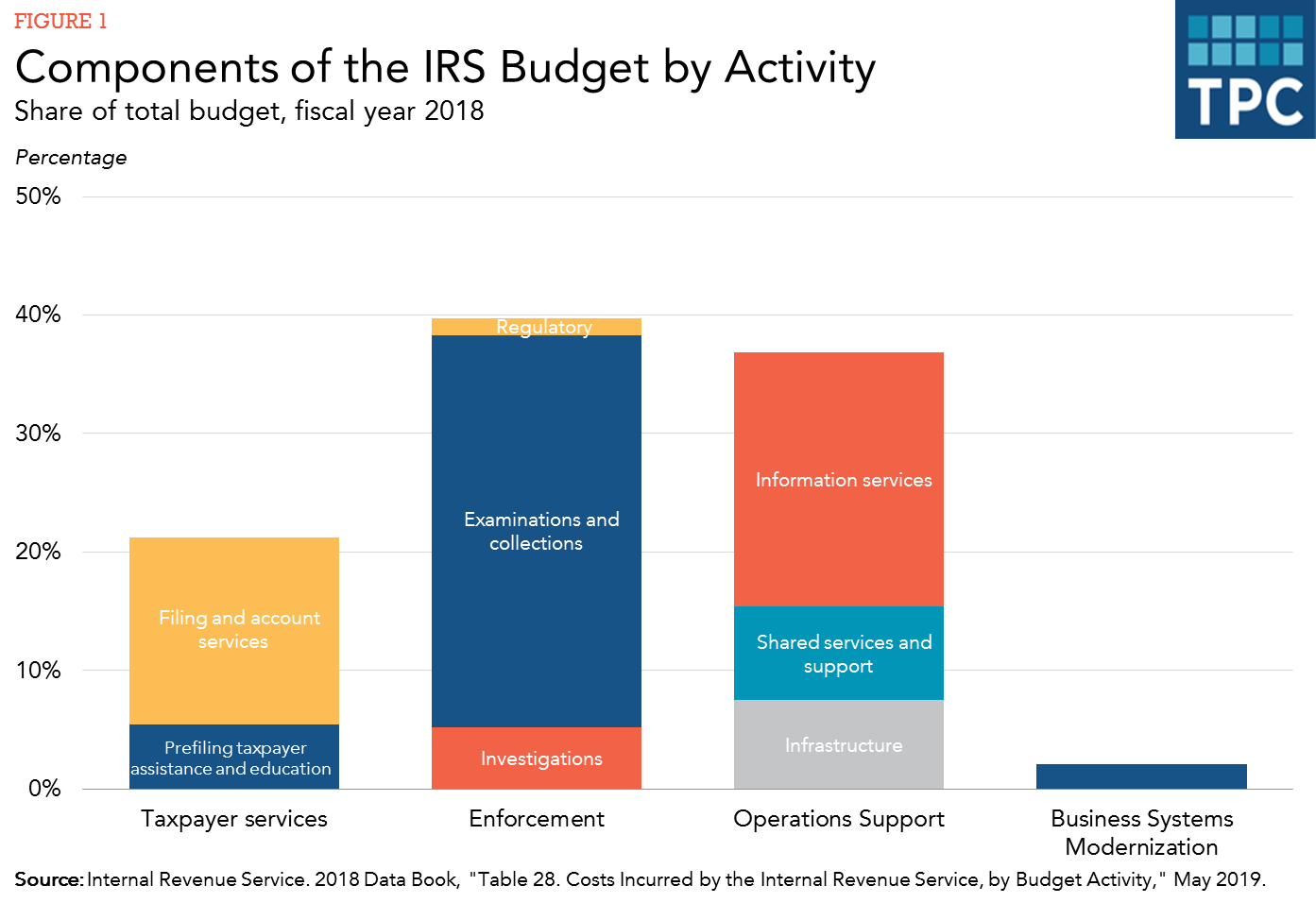

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Irs 1099 Misc Form For 2021 Payroll Template Irs Irs Forms

Search Engine Optimization Advertising Definition Kotler Understanding Search Engine Optimization Virtual Assistant Services Pinterest Seo Pinterest Expert